One of the greatest difficulties companies face today is managing their finances. A report by PwC indicated that 60% of finance executives say that outdated systems slow down decision-making. Manual bookkeeping delayed financial reporting, and decentralized access to data all contribute to making errors and losing out on business. Without a cohesive data-keeping system, organizations are bound to risk compliance issues, cash flow-related problems, and operational delays. Microsoft Dynamics Business Central solves financial management issues by streamlining and automating most of the time-consuming tasks: invoicing, budgeting, and reporting. It helps businesses make more informed financial decisions with access to real-time insights. From startups to enterprises, unifying financial operations in a system is the ultimate solution to stimulate growth.

Understanding Financial Management

Any business stands on financial management. The components are budgeting, accounting, cash flow management, and financial reporting. U.S. Bank found that 82% of small businesses fail mainly due to financial mismanagement. The accounting process, however, is still manual in most firms, yielding discrepancies and slow decision-making. Companies without a sound financial plan suffer from cash shortages, compliance issues, and unforeseen losses.

Microsoft Dynamics Business Central performs financial management by eliminating daily business operations. With it, enterprises can view their financial data in real-time for expense control and cash flows. Features such as automated invoicing and AI-based forecasting provide error reduction and better planning. Transparency becomes a hallmark of a centralized system whereby audit and compliance will be seamless.

Features of Microsoft Dynamics 365 Business Central for Financial Management

Microsoft Dynamics Business Central offers powerful financial management that is accessible to the accounting aspect. Automating invoicing, cash flow tracking, and tax compliance minimizes manual work and reduces errors. Gartner indicates that companies that deploy automated financial systems experience at least a 36% increase in efficiency. This would help businesses make more profits and ensure compliance by using AI for analysis and real-time data pretty much effortlessly.

General Ledger Management

The general ledger is the backbone of financial accounting that maintains records of all financial transactions to ensure they are accurate and compliant with accounting standards. With the automation of activities, along with real-time insights, Microsoft Dynamics Business Central facilitates the management of the general ledger.

- Integrated Chart of Accounts: A business may configure a structured chart of accounts to track financial activities seamlessly. For instance, a retail organization categorizes its expenses into store operations, marketing, and logistics, which in turn, makes it easier to analyze expenditures.

- Automated Journal Entries: System-generated journal entries for recurring transactions minimize human error. A logistics company, for instance, can automatically create entries for monthly lease payments and fuel expenses.

- Multi-Dimensional Reporting: Financial data can be analyzed by different dimensions in Microsoft Dynamics Business Central. For example, a global organization can track revenue and expenses by country, by department, or by product line.

Accounts Payable & Receivable

Healthy cash flow directly correlates with effective management of payables and receivables. Microsoft Dynamics Business Central empowers efficient vendor payments and customer collections.

- Vendor Invoice Management: Automating invoice processing safeguards timely payments. A construction company might interlock supplier invoices with project budgets to avoid overspending.

- Automated Payment Processing: Such systems allow the scheduling of vendor payments and expediting approvals. For example, a healthcare provider automates the payment to suppliers of medical equipment to safeguard business continuity.

- Customer Payment Tracking: Companies can track payments for overdue invoices and send reminders automatically. For example, a subscription-based business can configure reminders for its customers to renew their subscriptions before expiration.

Fixed Assets Management

Tracking fixed assets guarantees that the enterprise’s accounting records are maintained accurately and in accordance with the relevant laws. Microsoft Dynamics Business Central provides the tools for automated tracking of company assets and depreciation.

- Comprehensive Asset Register: Asset particulars can be maintained, for example, asset acquisition cost and exact location. A machine can be tracked through manufacturing plants.

- Automated Depreciation Calculation: Automated calculation of depreciation is done according to defined methods in the system. Take the example of a transportation company keeping track of the depreciation of vehicles for future replacement.

- Asset Lifecycle Management: Businesses can establish maintenance ceremonies and set renewals for contracts and insurances. For instance: an airline can create reminders set for servicing aircraft per requirements of safety compliance.

Bank Reconciliation

Bank reconciliations are necessary for cash flow tracking and the identification of discrepancies. Microsoft Dynamics Business Central automates this process to allow for accuracy.

- Automated Bank Statement Import: This system connects with banks to pull statement data, allowing for less manual intervention in data entry.

- Transaction Matching: It reconciles bank transactions with accounting entries and highlights mismatches. A retail chain may reconcile daily card transactions with bank deposits.

- Cash Flow Insights in Real-Time: Immediate availability of cash flow information encourages informed financial activities by businesses.

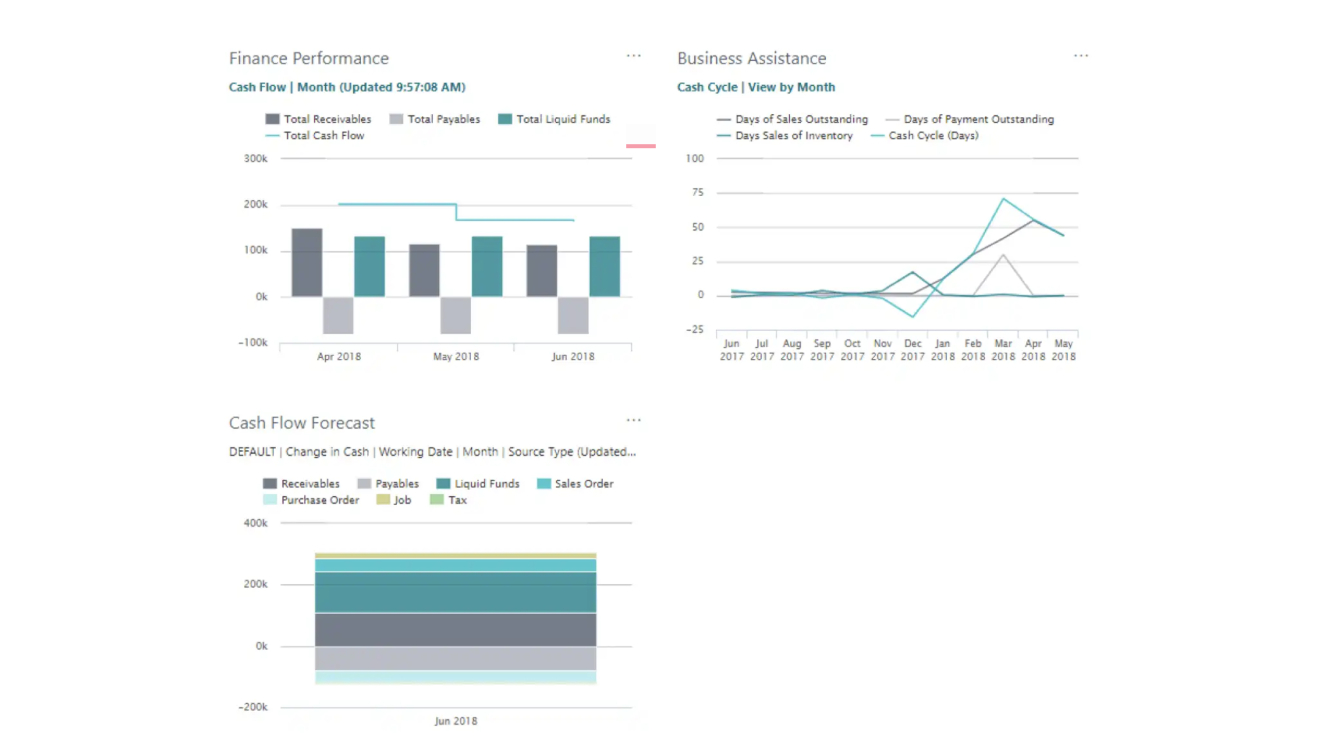

Cash Flow Forecasting

Accurate cash flow projection enables businesses to optimally manage liquidity and plan for future investments. Microsoft Dynamics Business Central offers wider cash-flow projection options.

- Integrating Financial Data: The system analyzes accounts payable, receivable, and budgets to ensure accurate forecasting.

- Scenario-Based Forecasting: The way cash flow is predicted against different economic conditions. Hotel chains may estimate revenue changes by seasonal trends.

- Enhanced Planning for Liquidity: Companies can plan their spending, investment, and loan repayment with accurate forecasts and financial data.

Financial Reporting

Financial reporting allows a business to analyze the performance of any given activity and the application of strategic control decisions. Microsoft Dynamics Business Central is cost-effective providing customizable tools for reporting.

- Automated Financial Statements: Includes balance sheets and profit-and-loss statements.

- Power BI Integration: This allows for the visualization of financial data and greater insight. For example, a tech startup can use Power BI to watch investor funding vs. operating costs.

- Custom Report Format: This allows the user to tailor reports to specific business needs for even more openness of financials.

Making and Collecting Payments

Built-In Payment Reminders – Companies can reduce late payments by setting up automated alerts.

Efficient payment processing strengthens relationships with vendors and customers. Microsoft Dynamics Business Central proves to be a formidable assistant in managing payments.

- Multiple Payment Mechanisms Support: Businesses can process payments through credit cards, electronic transfers, and digital payments.

- Automated Payment Scheduling: The system reduces the effort involved in processing recurring payments and approvals. For example, a SaaS company may automate billing for monthly subscriptions.

- Built-In Payment Reminders: Alerts can be configured to minimize any instances of late payments.

Year-End Closing

Proper year-end closing ensures compliance with accounting principles. Microsoft Dynamics Business Central makes the process more efficient concerning all year-end financial activities.

- Guided Procedure For Closing: The software provides a comprehensive wizard to assist in the closing of each financial period.

- Profit and Loss Transfer: This transfers profit and loss automatically into the new financial year.

- Audit-Ready Financial Records: The system ensures adherence to IFRS and GAAP guidelines to facilitate the auditing process.

Let’s look at some of the advantages of Microsoft Dynamics 365 and how it can streamline business operations.

Advantages of Microsoft Dynamics 365

Microsoft Dynamics Business Central has become a powerful financial management solution for businesses with automation, AI-powered insights, and cloud accessibility. It enables effective operation through streamlined processes, high efficiency, and sound decision-making for long-term business growth.

- Financial Management Automation – The platform automates some of the key financial processes, such as invoice preparation, budgeting, and reporting. These eliminate repetitive manual work, reduce errors, and ensure efficiency in operations so that finance teams can spend more time on strategic planning.

- Seamless Integration – Microsoft Dynamics Business Central offers integrations with other apps such as Microsoft Teams, Power BI, and Office 365. This will ensure seamless communication of data across various departments, enhancing collaboration and accuracy of reporting.

- Cloud-Based Accessibility – Business financial data can be accessed from anywhere, helping reduce IT infrastructure costs by as much as 30%. Cloud hosting offers security, automatic updates, and scalability.

- AI-Driven Insights – The system processes financial data using AI to analyze cash flow trend forecasts and improve the accuracy of the forecasts. Thus promoting businesses to make financial decisions proactively and minimize risks.

- Multi-Currency & Compliance Support – It takes care of global financial transactions along with multiple currencies and tax regulations. That way, businesses can comply with international financial standards and keep their risks for penalties at a minimum.

Using Microsoft Dynamics Business Central can take finances to a whole new level for an organization, but successful implementation requires some expertise. An accredited Microsoft Dynamics 365 partner will make your implementations easy, simple, and less costly by just customizing the platform to be in line with specific business needs. Experts handle data Migration, integration with existing systems, and user training; thus, there will be fewer mistakes and downtime.

The Bottom Line

Nucleus Research reports a noticeable operational efficiency increase of about 36% for firms pursuing ERP solutions with expert implementation. Best collaborations ensure compliance towards what the industry demands, as well as more security. That would be supplemented with continuing support maintenance updates and performance optimization, allowing businesses to concentrate on growth. Thus, reinventing the wheel is not necessary; it is possible to consult an expert on it. Looking to implement Microsoft Dynamics Business Central? Stream Solutions will assist you in streamlining activities for maximum efficiency. Contact us today for an expert hand!